Weekly Market Outlook – The Impossible Rally Lives On

In most cases, any sort of technically-driven look at the stock market would be best accomplished by starting with a micro view, and then backing out and putting the micro action into the context of a macro view.

Not this time though. Right now, at the midpoint of July in the third year of a presidential term, a bigger-picture perspective makes much more sense of the micro-action.

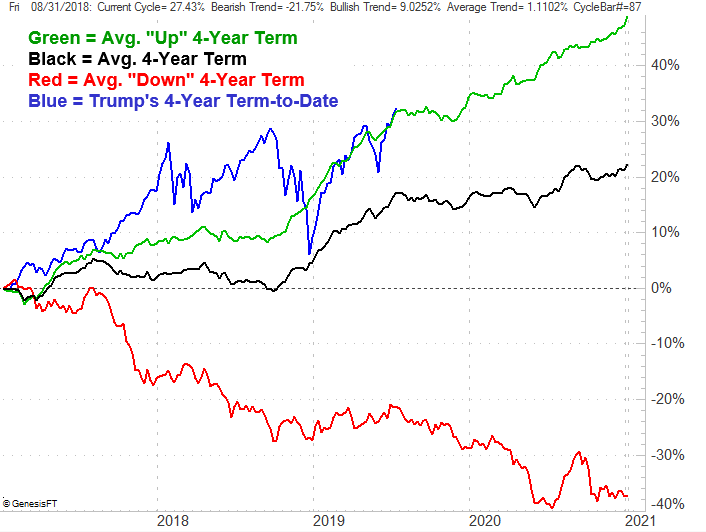

To that end, the graphic below is a plot of the market’s performance over the course of a four-year presidential term – good, bad, and the average – and where the market is on that path at this time. This year has been heroically bullish, but only because the end of last year was horrifying. But, last year’s big setback was the result of an exceedingly bullish end to the first year and beginning of the second year. On balance, where we are as of the end of last week is ‘about right’ for bullish four-year stretches under a president.

Average Market Performance, Four-Year Presidential Term

Source: TradeNavigator

No matter how you slice it, though, it suggests trouble is ahead.

While the typical July-October span is usually just a breakeven, on average, ending with a lull that leads into an October recovery, if the presidential cycle means anything at all, the latter half of the third year of any term is poor… even when the four-year span ultimately ends in gains. The average here is a 3% slide from mid-July to early November.

It’s hardly an idea that has to be etched in stone. But, it is a concerning reality at a time when the broad market is uncomfortably overextended.

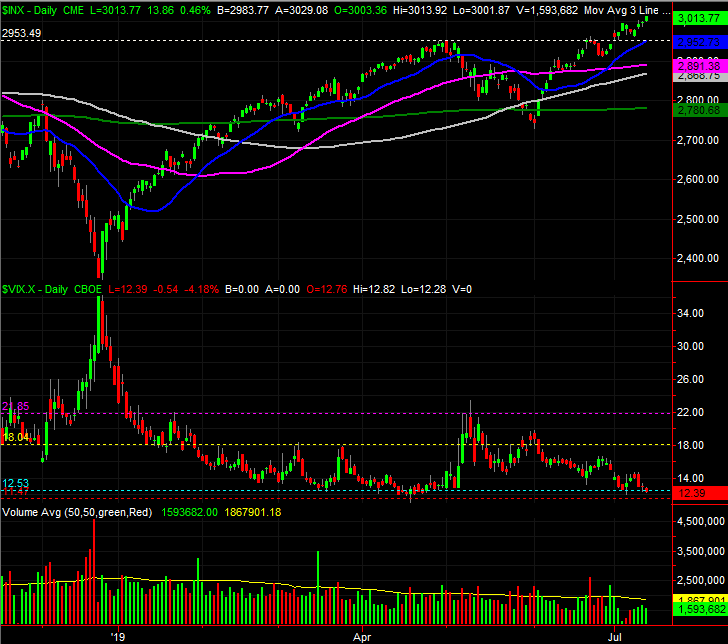

To that end, zooming into the weekly chart of the S&P 500 doesn’t require a great deal of scrutiny to appreciate just how unusual the past seven months have been. For those who need to quantify the qualitative though, the S&P 500 is now 8.6% above its 200-day moving average line, plotted in green. That’s well above the normal degree of divergence we’re historically seen.

It also can’t be ignored that there’s still little to no volume behind the advance since late June.

S&P 500 Weekly Chart

Source: TradeStation

Of all the concerns though, it’s the oddly low VIX once again that gnaws at hopeful bulls.

S&P 500 Daily Chart, with VIX, Volume

Source: TradeStation

For the record, the market can rally when the VIX is ‘too low.’ We saw it happen in May and Aril, and we saw it persist for the better part of 2017. It’s the equivalent to playing with fire though, particularly when the S&P 500 is valued at a trailing P/E of 18.8 and a forward-looking one of 180. Stocks were more expensive on 2015 and 2016, but largely thanks to bleeding oil companies. They’re more or less back to normal now, and that valuation is above the long-term norm. More than that, the argument that premium valuations are merited in a low rate environment hasn’t exactly stood up to scrutiny.

None of it means a thing unless the majority of the crowd is willing to let go of the idea that the Fed is entirely unwilling to let stocks slip into trouble. It almost looked like that was going to be the case in May, but when things became alarming, the stimulus cavalry started to ride. We’re still due for a pullback though… one bigger and better than the one we saw in May

Even so, any pullback could be quelled quickly. The key moving averages are all peppered from a low of 2780 to a high of 2953, any of which would likely at least try to act as a floor.

Ironically, one particularly strong bullish thrust would likely serve as a blowoff top as well, setting the stage for a wave of profit-taking as well that would plow through any technical support offered by the moving averages.

The key is the VIX, and though not shown on any chart above, the direction of the put/call ratio trend.

Tread lightly here. The tide feels bullish, but this isn’t when and where you want to start adding to long positions.