Weekly Market Outlook – The Buying Stopped When the Going Got Tough

Weekly Market Outlook – February 9th, 2020

We mentioned a week ago that the sheer speed of the previous week’s pullback set the stage for a rebound… one that may or may not last. The perfect kiss of the 50-day moving average line (purple) two Friday’s ago added to the prospect a knee-jerk bounce, with the provision of a technical support level. Like clockwork, the market did bounce, with the S&P 500 barely reaching another record high on Thursday.

S&P 500 Daily Chart, with VIX and Volume

Source: TradeStation

As we also cautioned a week ago, however, a quick bounceback isn’t necessarily evidence that higher highs await. In fact, several clues suggest we’re actually positioned to make lower lows again. And this time, the market may end up breaking under the 50-day moving average line that held it up two Friday’s back. Underscoring the potential for a pullback is the two bullish gaps left behind with Tuesday’s and Wednesday’s gains. Investors tend not to leave gaps unfilled.

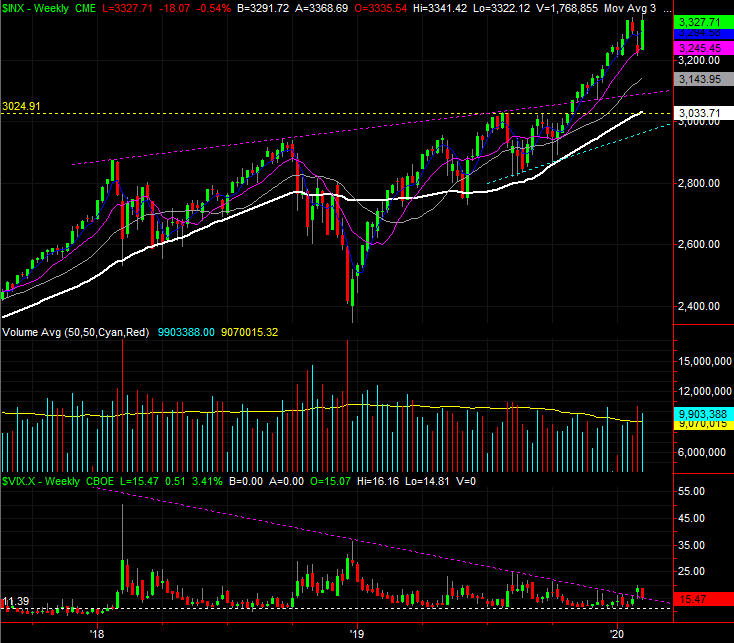

The weekly chart of the S&P 500 below puts things in perspective in terms of how overbought the market is at this time, although it also delivers a slight hint that the undertow is actually still bullish. Namely, even with Friday’s lull, last week was a big win, extending what’s become weeks’ worth of established momentum. It’s what’s on the other hand that bolsters the bearish case. That’s how far the S&P 500 has come since December of 2018, the lack of volume behind last week’s advance, and the VIX has punched above the falling ceiling that had been guiding it lower since late-2018.

S&P 500 Weekly Chart, with VIX and Volume

Source: TradeStation

And the lack of bullish volume — or lack of volume behind the market’s gainers — isn’t just a gut feeling. Even with Tuesday’s and Wednesday’s gains seeing above average volume to the upside (the amount of shares traded with shares that logged a gain those days), it wasn’t wildly greater volume, and it neither persisted nor broke the downtrend of bullish volume that’s been in place since late last year (UVOL). Conversely, the NYSE’s bearish volume (UVOL) has clearly been trending higher since late last year, even though stocks have somehow still managed to drift upward during that period.

NYSE Up, Down Volume Daily Chart, with S&P 500

Source: TradeStation

This continues to be our key issue for this rally, though it hasn’t seemed to bother anyone else yet… the buyers in particular. There don’t seem to by many of them, but there’s still more of them then there are sellers. The bears may be unwilling to do their thing here, having been burned too many times in the recent past by betting against a market that’s unwilling to go down. Every news item of development that was an opportunity to buoy stocks has been interpreted in the best possible light, spurring indiscriminate buying. The music will stop sometime and leave somebody without a chair, but it clearly hasn’t stopped yet.

Ditto for the NASDAQ Composite, by the way. The composite hit a new high on Wednesday, but immediately started to fade. There was never much volume behind the move. Notice the VXN has also broken above its long-standing technical ceiling.

NASDAQ Composite Daily Chart, with VXN and Volume

Source: TradeStation

The bottom line is, this week will be a test. The weight of the gains since October are still bearing down. That hasn’t been enough to matter yet, but that prospect still looms above. They key remains what happens at the 50-day moving average line (and for the NASDAQ, there’s also a rising technical support line in play right around there). There’s wiggle room for a little weakness, but not a lot.