Weekly Market Outlook – Stocks Squeezed Into an Inflection Point

Weekly Market Outlook – September 2nd, 2019

Last week at the website we suggested the market would be forced into a showdown… before the end of last week. That is to say, either the bulls or the bears were going to be forced to make a stand. A key support level would have to break, or a key resistance line would.

That didn’t end up happening. Rather, the market managed to find a way to postpone committing to one direction or the other. The ceiling wasn’t breached, nor was th floor. We were certainly pushed closer to that showdown though.

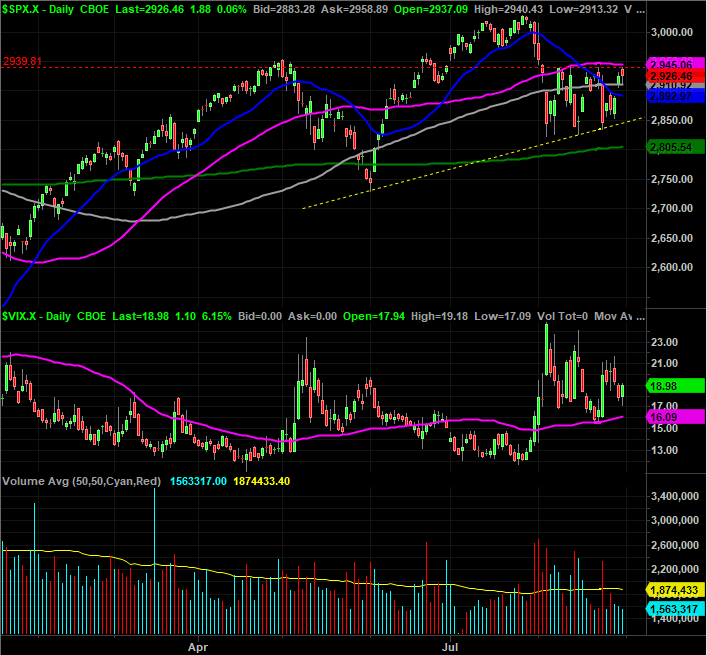

The daily chart tells the tale. A rising support line, plotted in yellow, has been established as of last week. Also confirmed last week is the establishment of the horizontal ceiling at 2939.80, marked with a red dashed line.

S&P 500 Daily Chart, with VIX and Volume

Source: TradeStation

Making matters more indecisive is the fact that Friday’s action was capped at the 50-day moving average line (purple), but supported by the 100-day moving average line (gray).

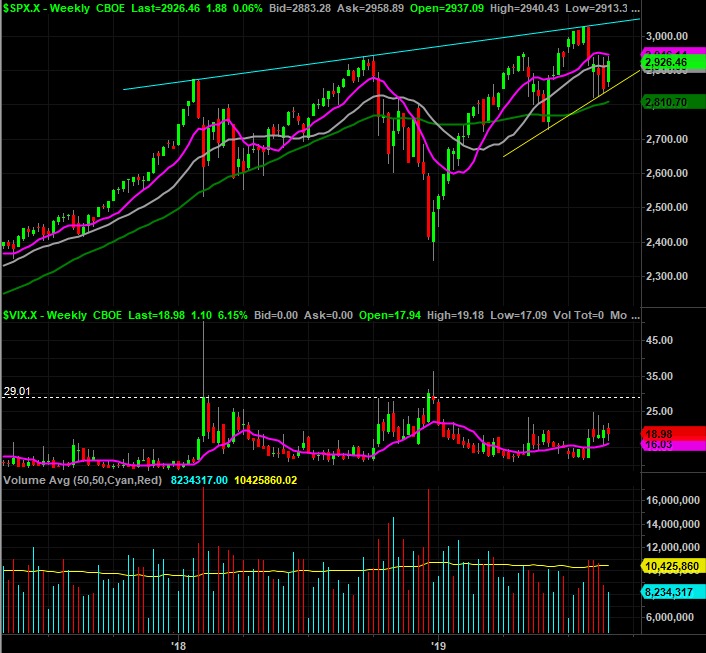

Zooming out to the weekly chart puts things in perspective. Namely, it looks as if the index is being squeezed toward the point of a newly-formed converging wedge pattern. The upper boundary, of course, is plotted with a light blue line.

S&P 500 Weekly Chart, with VIX and Volume

Source: TradeStation

The weekly chart, coupled with the daily chart, shows is something else that could prove troubling for the would-be bulls, however.

Take a look at the VIX on the daily chart. It was up on Friday, renewing an uptrend that was sparked by a kiss of its purple 50-day moving average line a week earlier. The weekly chart’s VIX bars also suggest it’s been trending upward for some time, but has yet to reach the 30-ish area that would normally be seen at a trade-worthy bottom.

It’s also clear that, not unlike May’s tumble, the 6% tumble from July’s high to August’s low wasn’t really enough to be called a capitulation, or even a mini-capitulation. Ditto for the NASDAQ Composite, which is finding similar support and resistance.

NASDAQ Composite Daily Chart, with VXN and Volume

Source: TradeStation

It’s also worth noting this is a bearish time of year for stocks. Thus far the bulls have defied the norm, though it’s still possible traders could end up dishing out the usual weakness. That usually lasts through early October, though in this instance it’s possible that weakness could persist into November.

The situation is unfurling against a very tricky backdrop as well.

There’s no way of denying traders are being led, for better or worse, by headlines right now. The yield curve inversion has been interpreted as a red flag, but it’s the market that made the inversion take shape. They often signal recessions, but such rampant expectations of a recession in the near future may or may not be merited. The irony: A stimulative rate cut could — and likely would — re-invert or further invert a yield curve.

It’s also worth noting that recessions usually take shape when they’re not expected. The fact that a huge swath of investors are expecting one now suggests one won’t take shape. That won’t prevent the market from trying to fool the masses into thinking one is inevitable though… with a steep selloff.

If we get one, watch the economic data carefully. If it remains healthy or the Fed turns up the stimulus spigot (or there’s some sort of resolution to the tariff war with China), that selloff could be a buying opportunity much like the one in December was.

In the meantime, watch the boundaries established by the newly-formed converging wedge, as well as the 200-day moving average line at 2805. It’s a make-or-break line right now as well.