Weekly Market Outlook – Traders are Holding Out for Good News

Weekly Market Outlook – September 29th, 2019

Interestingly, the early September high for the S&P 500 didn’t surpass the July high… the first time the index has failed to make a higher high in over a couple of years. It’s not yet been followed by a lower low, but that’s not to say it can’t happen.

The most interesting aspect of last week’s action, however, is where the selling finally stopped. The S&P 500 tested the 50-day moving average line (purple) action as a technical floor. But, it didn’t break under it.

S&P 500 Daily Chart, with VIX, Volume

Source: TradeStation

It could still do so. And, there are several indications that it probably will. Among them are the way the VIX is coming up and off of – well, near a – key low around 13.0. Also note that the VIX is struggling a bit to move above a ceiling around 18.00, which has proven itself to be a resistance area before. It’s likely that the VIX will hurdle 18.0 and the S&P 500 will fall below its 50-day line right around the same time, if a breakdown is going to take shape.

The weekly chart, as usual, puts things in more perspective.

S&P 500 Weekly Chart, with VIX, Volume

Source: TradeStation

The problem for the bulls is (still) the calendar.

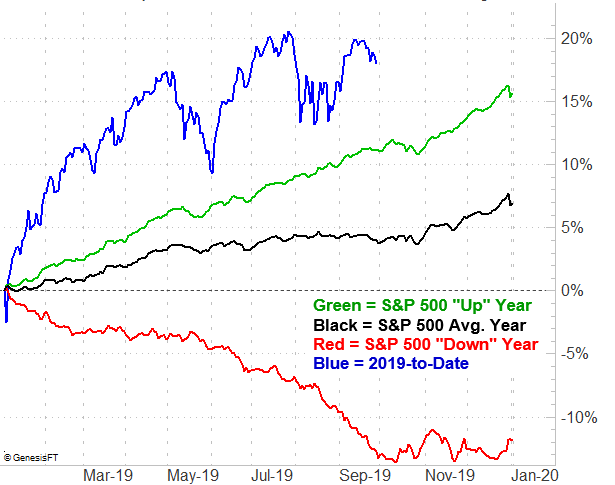

It’s an idea we’ve presented before that merits an update now. That is, we’re in the midst of a time of year that isn’t especially kind to the market. Yes, September is usually a tough month, but recently, that trouble has tended to extend even through late October. And, we’re already overextended more than we should be for this time of year.

S&P 500 YTD Performance vs. Average Performance

Source: TradeNavigator

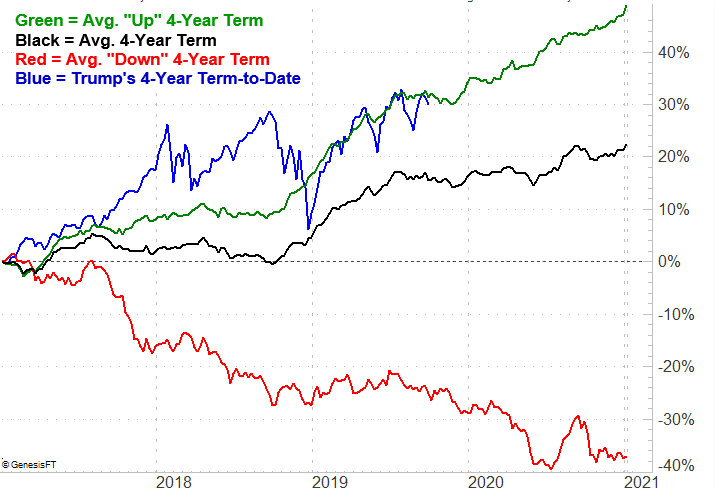

The picture is even more concerning when looking at this time of year for the third year of a Presidential term… when investors on are edge and uncertain about the future as they start to see the field of candidates take shape.

S&P 500 Presidential Term Performance vs. Average Performance

Source: TradeNavigator

The good news? The fourth year of a Presidential term is usually a good one. The bad news is, when it’s not a good fourth year, it’s a very, very bad fourth year.

The X-factor is of course the prospective cooling of the trade war with China. It may or may not actually bring any real relief to companies based on either side of the Pacific Ocean, but it will be perceived as a bullish backdrop. That may well be enough to push stocks higher, and out of their current funk.

At the other end of the spectrum, if for some reason the scheduled meeting between Trump and Xi Jinping for October doesn’t actually yield any real change, that too could lead investors into a bearish mindset (merited or not).

Just keep an eye on where the S&P 500 is in relation to the 50-day moving average line, and where the VIX is in relation to the 18.0 level.