Weekly Market Outlook – Still Defying the Odds

Talk about indecision. The very next day after broaching record-high territory two weeks ago, the S&P 500 slipped into a nosedive. Four days later, it was on the mend again. While stocks ended the week on a high note, the market also ended the week on the fence. Anything could still happen here, and stocks are still more subject to headlines than a reflection of current (or even prospective) valuations.

Assume nothing here.

The ceiling in place for the S&P 500 is, of course, right around 2953.5… where it peaked in April, and where its highest close and best open was in June. It traded a little higher than that on June 21st, but hasn’t opened or closed above there since. At the other end, the 20-day moving average line currently at 2890 is the floor to watch, though the 50-day line at 2880 may be more important. Either way, a test is coming. The bulls or the bears are going to have to take a stand. That stand should set the stage for a more prolonged move.

S&P 500 Daily Chart, with VIX, Volume

Source: TradeStation

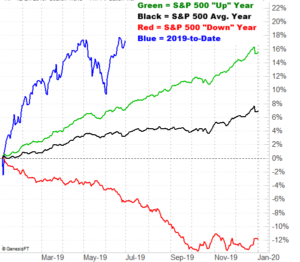

Here’s the problem with the possibility of more bullishness… it’s against the odds. Not only is the S&P 500 much higher than it should be at this time of year, the summer months are generally lethargic.

S&P 500 Daily Average Cumulative Performance

Source: TradeNavigator

On the other hand, in a good (bullish) year, the S&P 500 is more than capable of making summertime progress. All the same, the market is starting out this year’s summer further ahead than it would normally start it out.

Interestingly – and this is the part that quietly taints the rally effort thus far – the NASDAQ Composite isn’t leading the bullish charge. It’s lagging, currently nowhere near its peak high from April. Generally speaking, the tech-heavy and growth-heavy NASDAQ should lead the way. The fact that it isn’t indicates that investors may not have an overwhelming amount of faith in the advance effort that took shape late last week.

NASDAQ Composite Daily Chart, with VXN, Volume

Source: TradeStation

It takes a look at the weekly chart to really put things in perspective. The past four weeks, even with last week’s lull, have been unusually strong, sidestepping what was very close to turning into a four-alarm meltdown. The rebound has carried the S&P 500 back to an inflection point, but no higher.

S&P 500 Weekly Chart, with Volume

Source: TradeStation

All that being said, the key here is (still) the VIX. It’s back to the 15/16 area where it’s been gravitating to and from for the past few weeks. There’s room for more downside from the VIX, which leaves room for the market to make gains. But, there’s not a lot of room… and the market is overbought as is.

Ironically, the market’s advance for the past four weeks brings it dangerously close to a point where there’s little to no room left to keep climbing. A little bullish straightaway could actually be the worst thing for stocks, in the grand scheme of things. That peak could and should happen around the time the VIX tumbles back to the bigger support area around 11.

Conversely, if stocks somehow tip over here – if there’s no trade deal reached anytime soon – there’s lots of room and reason to expect a pullback. The 200-day moving average line around 2770 would be the first checkpoint floor, and the VIX’s ceiling around 30 would be its first checkpoint target.

That’s a lot of ‘ifs’ though. Problem is, there’s very little uncertainty helping shape the foreseeable future.

Still, you have to like the fact that the momentum is bullish.

-Price