Weekly Market Outlook – Coronavirus Supplied the Nudge, But Stocks Were Already Vulnerable

Weekly Market Outlook – January 26th, 2020

We’ll start this week out with a detailed look at the daily chart of the S&P 500, just to focus on one big thing. But, first things first.

In retrospect, the near-17% rally from October’s low should have been suspect to begin with. The market can and does make such moves, but they’re rare, and usually result in a rather punitive correction. That’s not to say they start bear markets, but traders lost perspective. Earnings growth is fairly stagnant, as is economic growth. The bulls charged anyway, but that advance was always on borrowed time.

Friday’s bar is the strongest clue yet that the pivot has been made. Specifically, it’s the shape that’s so concerning. It’s an outside day reversal, meaning the opening was above Thursday’s high, but the close was above Thursday’s low. And, the intraday direction on Friday was in the opposite direction of Thursday’s flow. This sweeping change of heart often indicates a reversal has begun, particularly when it takes shape after a prolonged rally.

S&P 500 Daily Chart, with VIX and Volume

Source: TradeStation

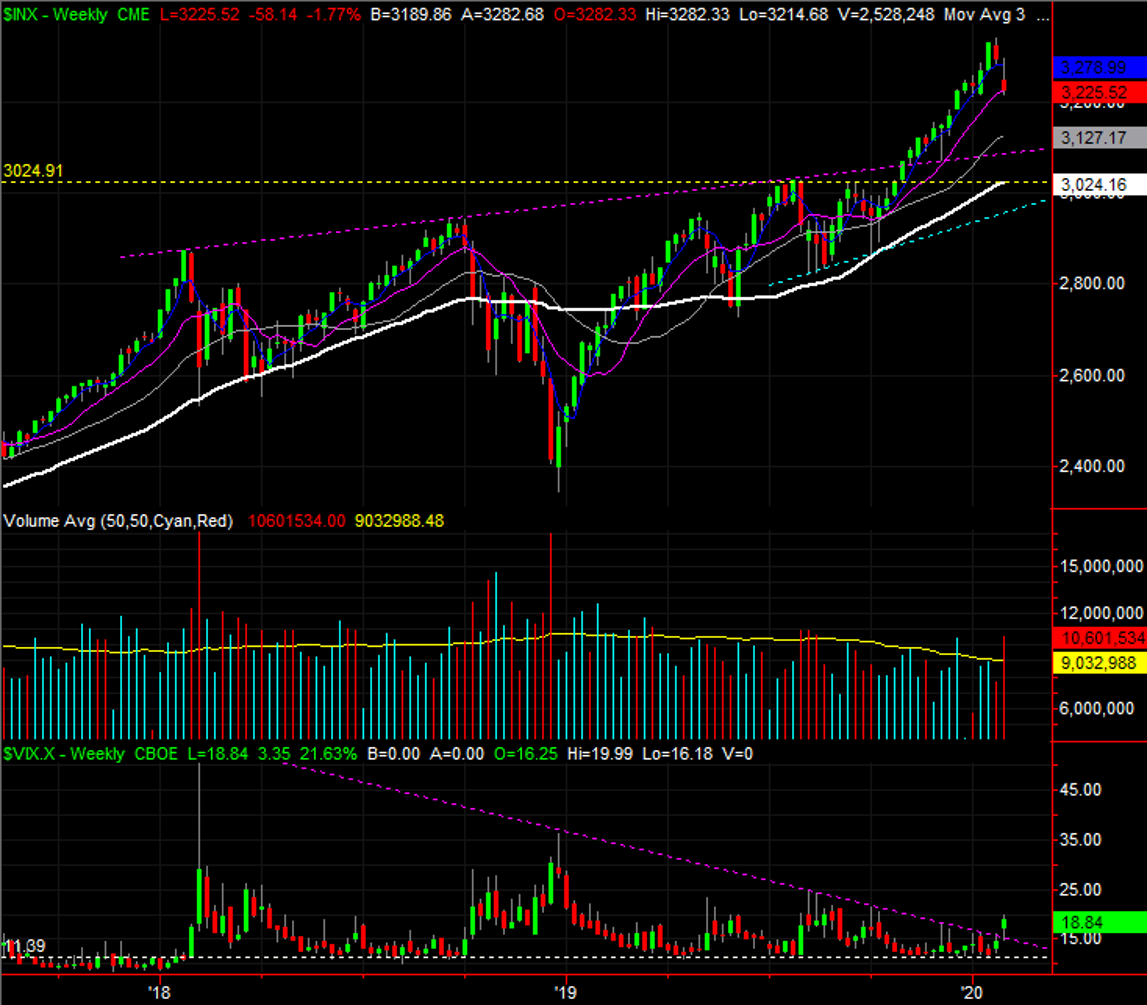

The reversal, however, isn’t quite complete. There’s one more item to cross off the checklist, so to speak, before the S&P 500 slips into more trouble than it can work its way out of. The VIX needs to push above the falling resistance line (purple) that’s been steering it lower since August of last year. The VIX took a poke at that ceiling on Friday, but only brushed it without clearing it. In fact, as the weekly chart shows, the VIX’s ceiling goes back to its peak from late 2018. The same weekly chart also paints a picture of how much out of character the past seventeen weeks have been.

S&P 500 Weekly Chart, with VIX and RSI

Source: TradeStation

Ditto for the NASDAQ and the VXN, by the way, although the NASDAQ’s daily chart has cued up one key clue to the prospective pullback that the S&P 500’s chart hasn’t. That is, the composite has also formed a couple of different support lines (yellow) stemming from lows made since October, both of which happen to align with key moving average lines. The first of those floors is the 20-day moving average line (blue) at 9186, and the other one is the 50-day moving average line (purple) at 8869. Once the first one breaks — if it breaks — be concerned. If the second one breaks as well, be worried.

NASDAQ Composite Daily Chart, with VXN and Volume

Source: TradeStation

Putting the slightly bearish spin on the matter is yet another clue that doesn’t readily appear on any of the charts above. That is, the market’s breadth (advancers and decliners) and depth (volume) is leaning in a bearish direction. It has been for a while, but turned decidedly so last week.

The chart below tells the tale, comparing the S&P 500 at the very top to the NYSE’s bullish volume (UVOL), bearish volume (DVOL), daily advancers (ADV) and daily decliners (DECL). The daily data is too erratic to use, but when a moving average of each is overlaid on each data set, you can get a feel for the underlying trend. Even though the market’s been rising since the very end of last year, up volume ad advancers have been deteriorating. Simultaneously, the NYSE’s daily decliners and bearish volume have both been rising despite the S&P 500 itself continuing to drift higher.

S&P 500 vs. NYSE Up/Down Volume and Advancers/Decliners

Source: TradeStation

That’s not to suggest the bulls won’t shrug off the seemingly bearish breadth and depth data. They certainly did in December, after November saw a swell of decliners and bearish volume. All it took was that December 3rd stumble to hit the “reset” button to renew the rally. The market’s up another 10% since then though, which makes the bulls less likely to step in again.

To that end, the trick for the bears will be pacing. Sudden plunges could be met with a new round of buying. A slow, smoldering pullback that accelerates on the way down is actually the more difficult train to stop.