One of my favorite trade set-ups is what I refer to as a “Volatility Compression Squeeze”.

The following Sector ETFs have all entered into a Volatility Compression Squeeze on the daily time frame. Once a squeeze is identified then the underlying security in the squeeze can be monitored for a Momentum Break-out Trade.

All traders should recognize that markets move between volatile periods and quiet periods, when markets will consolidate after a big move up or down. Skilled traders get positioned during the quiet times in order to take advantage of the inevitable spike in volatility that will surely follow.

I call this phenomenon a “volatility compression break-out”. Once a stock has been identified to be in a volatility compression, where price moves in a sideways trading range, a trader then has time to construct a trade set up that will take advantage of the volatility spikes that generally follow.

These break-outs are usually very strong and fast, which is the perfect environment to capture profits from both Weekly Option day trades and swing trades.

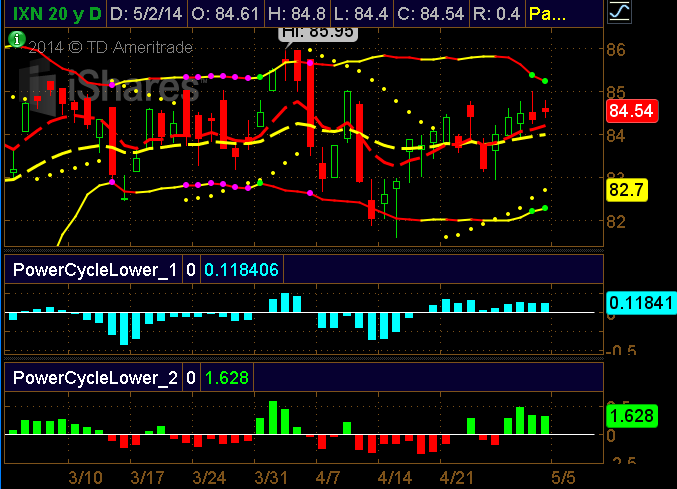

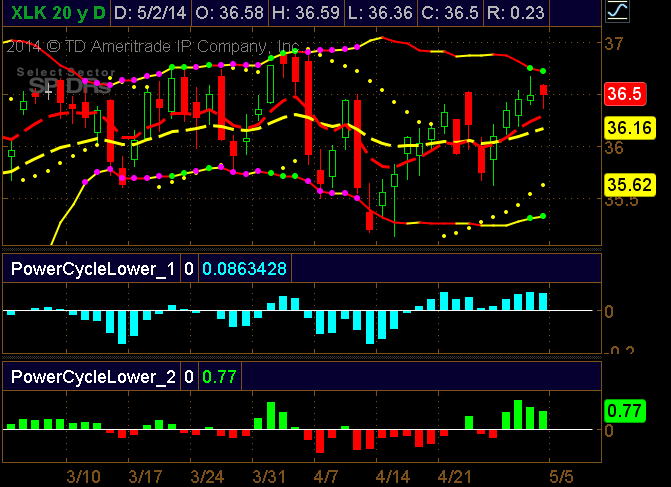

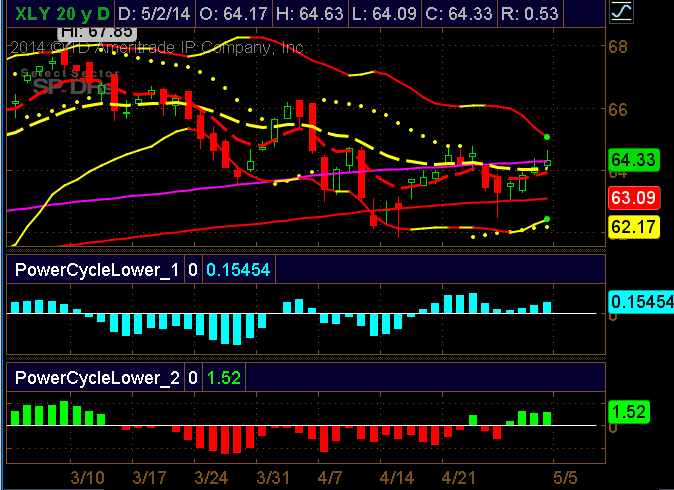

Here are 6 ETFs that have interred into a Volatility Compression Squeeze. My trading model, the Power Cycle Trading Model, is programmed to identify these type trade set-ups. The compression squeeze on these charts is identified by the green dots on the upper and lower bands. Each dot represents one day.

ETFs in Volatility Compression Squeeze:

IBB (NASDAQ Biotechnology ETF)

XRT (SPDR S&P Retail ETF)

XLK (SPDR Technology Select ETF)

IXN (ISHARES Global Tech ETF)

XLY (SPDR Consumer Did Select ETF)

GDX (Gold Miners ETF)

Another great way to take advantage of an ETF squeeze is to scan the stocks that make up the ETF looking for any squeeze set-ups on the stocks. Stocks will generally have a much greater implied volatility than the ETF making them ideal for a weekly option breakout trading strategy.

Larry Gaines

PowerCycleTrading.com