Weekly Market Outlook – Stocks Are Still on the Wrong Side of the Fence

Weekly Market Outlook – August 18th, 2019

Last week we explained the market was ‘messin with ya,’ just to keep anyone on either side of the table from getting complacent. It was doing so by virtue of ending the week in question right in between all of its key moving average lines.

Stocks are still messin’ with ya, trying to talk people into (and out of) trades. This time the S&P 500 is doing so, underneath another important moving average line, but ending last week on the rise… testing that moving average line as a ceiling. Most traders are very unsure of what lies ahead, and that’s what the market (subconsciously) wants. We’re not there yet, but we’re closer to the point where stocks shock or jolt the masses into panic-driven action. That will bring a close to the indecision.

The only question is, what will that look like? Will it be a full-blown capitulation? We need one to be sure, even though it’ll hurt at the time. Or, perhaps it will be a slow roll into a new uptrend that gradually re-inspires confidence on the way up.

In any case, a look at the actual charts is helpful, even if not conclusive.

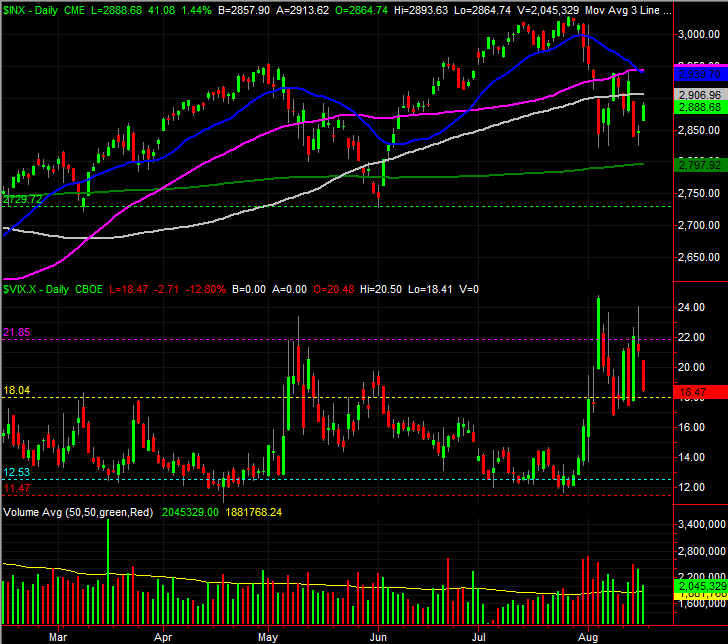

The S&P 500 ended last week below its 100-day moving average line, plotted in gray on the daily chart below. That’s the big change from last week. But, giving credit where it’s due, on Tuesday, Thursday and Friday, the volume behind those gains was quite healthy. Monday’s down-day volume was weak, while Wednesday’s loss was made on the highest daily volume of the week. On balance though, the buyers made some noise, even if they technically lost ground.

S&P 500 Daily Chart, with VIX, Volume

Source: TradeStation

It may or may not matter, but take note of the fact that the S&P 500 did NOT touch the green 200-day moving average line last week. Instead, notice that the index appears to be turning the 2824 area into a floor.

Zooming out to the weekly chart, as always, puts things in much-needed perspective. It’s in this timeframe we can see just how modest the pullback to-date has been. The S&P 500 only fell about 6.7% from its July high to its August low, which isn’t much. The early 2018 stumble was bigger, and the October/December selloff was MUCH bigger. May’s selloff was about as big as the current one has been so far, which may be part of the reason it was so easy to get back into a bearish mode again so soon.

S&P 500 Weekly Chart, with VIX, Volume

Source: TradeStation

The weekly chart also points to another problem that’s yet to be addressed, and was never addressed in May – the VIX never reached ‘painfully scary’ levels near 30 last week, or the week before. For the market to make a good, complete, blowout bottom the VIX really needs reach that level.

Ideally, the S&P 500 will find support at the 200-day moving average line (near 2800) at the same time the VIX surges. That, however, may only be wishful thinking. The index shrugged off the May break below the 200-day moving average line, but we may not be so lucky with the next test.

Same story for the NASDAQ Composite.

NASDAQ Composite Daily Chart, with VXN, Volume

Source: TradeStation

As a reminder, this is a time of year that’s lethargic for the market, at best. In some cases it’s downright bearish. Rarely is it bullish. It’s particularly rough patch for the third year of a presidential term (which we’re in now). There would be nothing unusual about more weakness here than we’ve already seen.

Bear in mind there’s room for the market to rise from here before revisiting key moving average lines. For the S&P 500, that’s the 20-day moving average line (blue) and the 50-day moving average line (purple), both at 2940. Don’t jump to conclusions about a great start to this week.